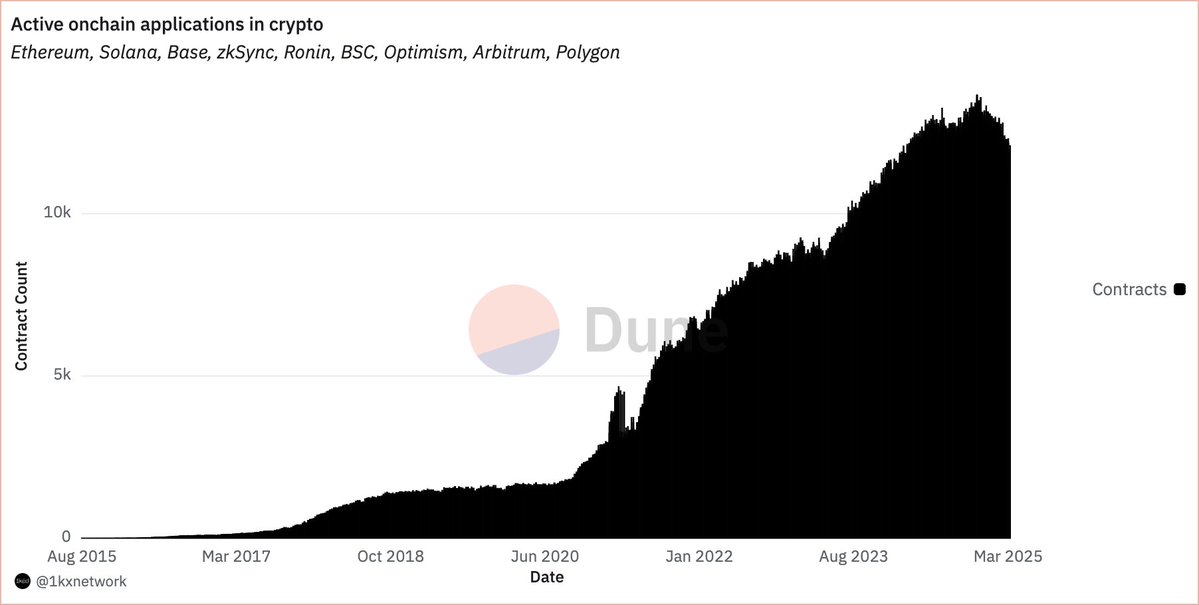

There have never been more tokens, applications, and chains in crypto, and participating onchain as a user has never been more confusing and complicated. Today, users heavily rely on manual ways to discover, navigate, and participate onchain with applications. User education and onboarding are fraught with friction and overly dependent upon real life events for end-user activation.

Users do not know what to trust and who to trust.

Crypto currently exists in a highly fragmented pre-aggregation state comparable to the pre-search engine era of the Internet (90s). At that time, users similarly relied on highly manual means of content discovery, such as physical demo CDs, forums, and link directories.

This not only represented a significant friction point for onboarding users to the internet but also provided an opportunity for those who could solve the fragmentation problem to own the end-to-end web browsing experience. AltaVista (1995) and Yahoo (1995) were first movers as search engines providing aggregation of content, but the opportunity was eventually captured by Google (1998), which leveraged its position to directly monetize their traffic with advertising – which funded verticalization into other web products such as email, maps, and video, as well as infrastructure such as cloud and AI.

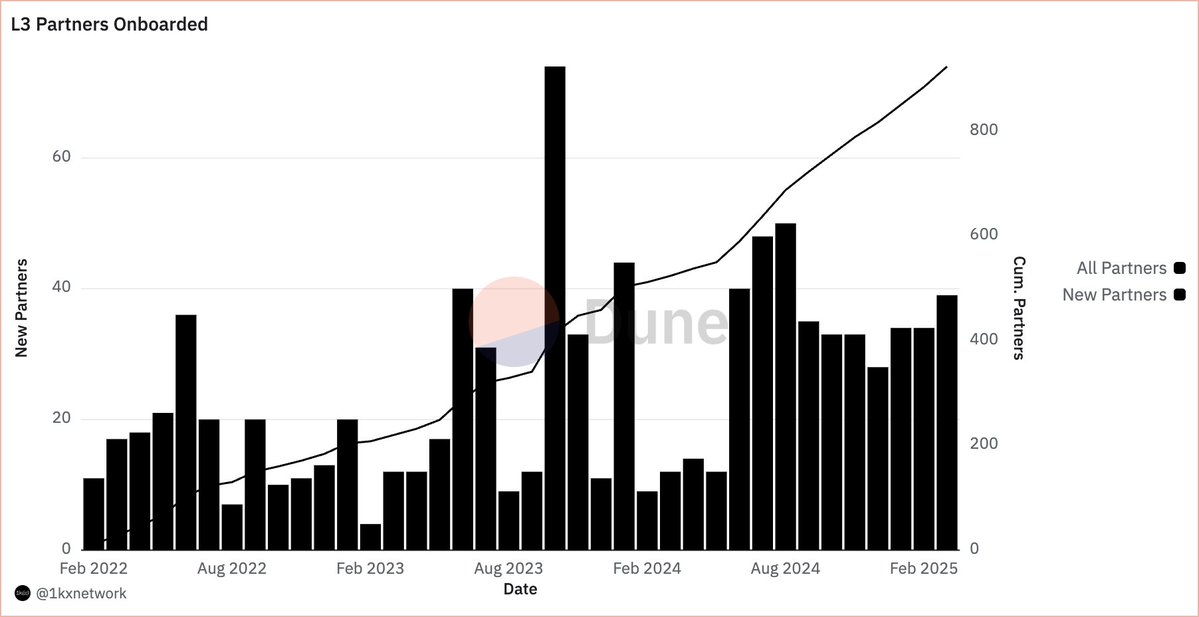

As the current leading platform that aggregates opportunities to earn and participate onchain with one’s attention, time, capital, and labor, we believeLayer3($L3) is firmly positioned to emerge as a leading aggregator of crypto. Since launching in February 2022, Layer3 has become the highest-transacting application aggregator, with over 150 million user actions completed across 33 chains, 900 applications, and 7.3 million unique users. Similar to Google, by owning aggregation, Layer3 is well positioned to execute a verticalization strategy.

We believe Layer3 will emerge as one of the biggest consumer platforms, and we are proud to announce that 1kx has acquired a meaningful position in $L3 through a series of liquid purchases on the open market. In this piece, we’ll share 1kx’s thesis around our $L3 purchase and the thinking that drives our conviction.

1. Application aggregation as a new window of opportunity

There was little you could do beyond trading for the first 9 years of crypto.

As a result, centralized exchanges (CEXs) have dominated the relationship with end users through their role as aggregators, curating assets for retail trading. As market leaders, Coinbase ($48bn market cap) and Binance ($84bn market cap) have grown to become massive winners through this positioning.

For the longest time, CEXs have cornered this aggregation opportunity.

However, since 2017, we’ve witnessed the need for aggregation beyond asset trading, first with ICOs that drove users directly onchain at scale for the time time, and once again in 2021, where we witnessed a Cambrian explosion of decentralized finance, games, collectibles, and other onchain applications emerge. Today, the number of applications and chain ecosystems have only continued to proliferate and grow, and so have the number of opportunities for end users to earn and participate onchain with their time, energy, attention, and reputation.

While trading is still the driving majority of retail into crypto today, we believe that this will dramatically shift toward onchain applications over the coming years. Opening up the need for aggregation at crypto's application, content, and incentive layer. We believe this window of opportunity will allow an emerging leader to establish and own the whole end-to-end user relationship for the next major wave of crypto users.

Those who can capture this opportunity will become crypto's most defensible consumer platform in the coming years.A new aggregation opportunity is wide open for Layer3 to capture.

2. Aggregating opportunities to earn

Layer3 aims to become the first point of contact for consumers on their crypto journey and the most user-friendly and efficient platform for:

Learning about crypto and understanding how to participate

Discovering new chains, new applications, and new tokens

Participating in onchain incentive programs and opportunities to earn

The goal is to intercept users far earlier in the crypto onboarding journey, allowing users to get started with Layer3 with initial deposits of $10-$30 USD rather than requiring larger amounts of discretionary income, which is often a barrier to entry for investments or trading. Unlike most crypto platforms, which avoid acknowledging that earning money is the main goal for most users, Layer3 embraces this, optimizing the entire experience to help users maximize rewards for their time, energy, and attention.

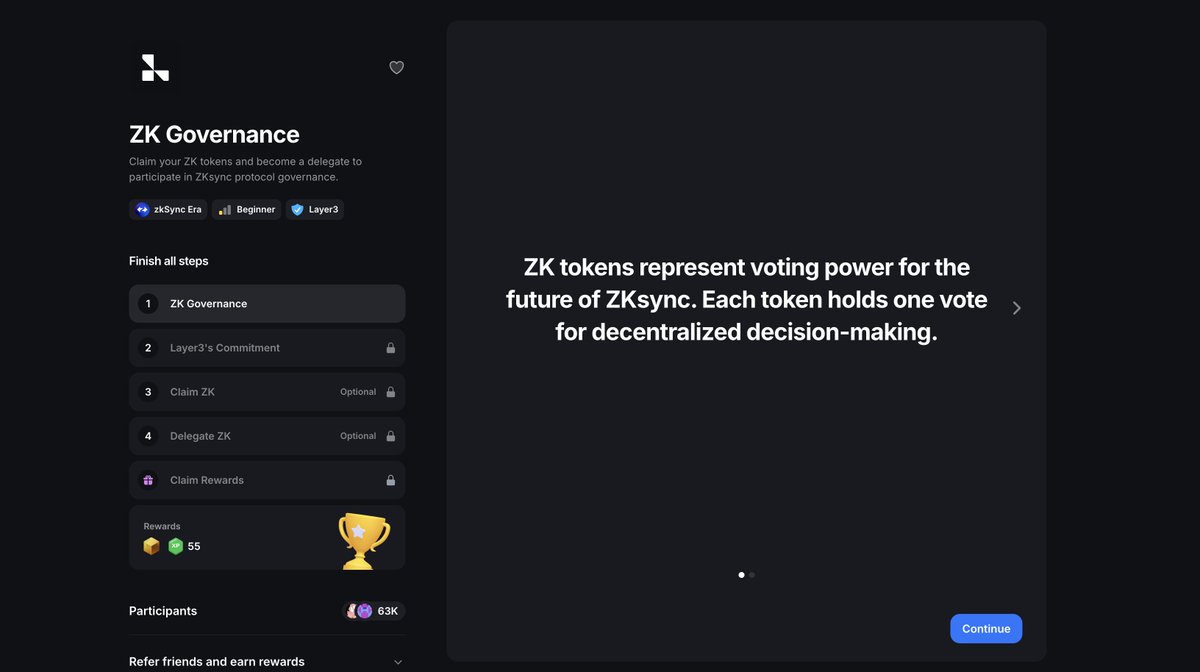

Layer3 achieves this gamification of participation through ‘missions’, which guide the end user through the steps of using an onchain application. Through these missions, users build progression for their Layer3 reputation, which provides downstream benefits such as access to exclusive quests and the opportunity to earn $L3.

Layer3 has been optimized to create trust with users, educating them on how to participate onchain, and is designed entirely for users who aren’t technical.

Google indexes information. Layer3 indexes onchain opportunities to earn.

Today, Layer3 aggregates onchain transactions across 900+ applications on Base, Solana, Arbitrum, Monad, Berachain, zkSync, Avalanche, BSC, Unichain, Linea, Fantom, Polygon, Blast, Zora, and more, totaling 33+ networks. A new application is indexed to Layer3 nearly every day, and this pace is only starting to accelerate.

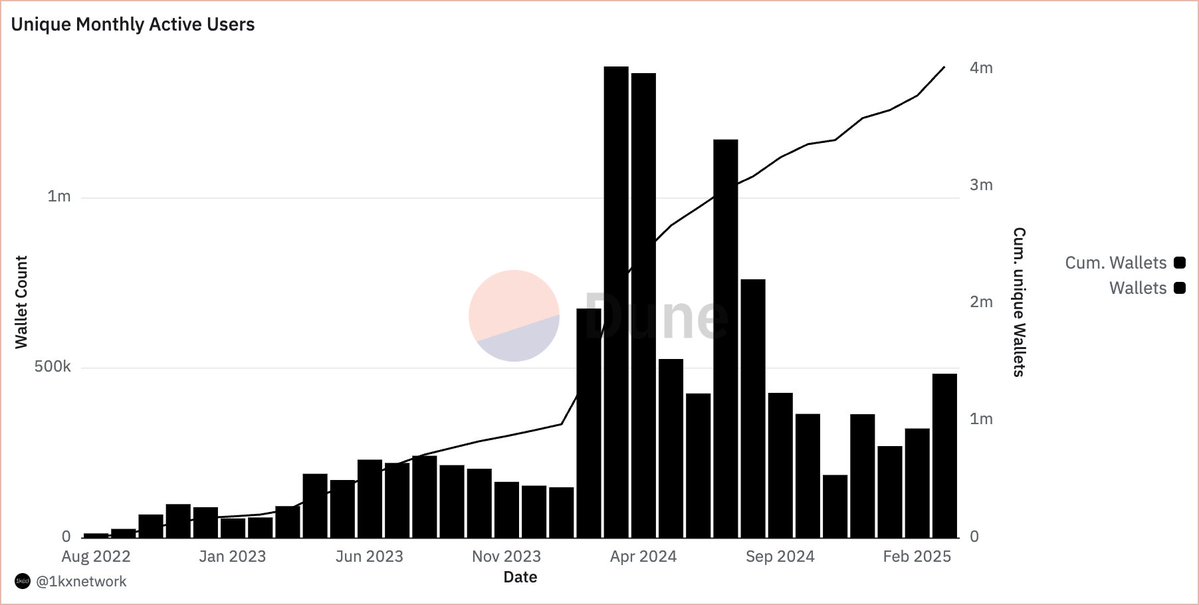

Launched in February 2022, Layer3’s traction peaked in mid-2024, reaching over 1.38 million unique transacting MAUs. Today, there are 480,000+ MAUs as of this recent March 2025.

3. Layer3 is the home to crypto's most active and engaged super users

While there might be criticism around the quality of Layer3 users, in reality, Layer3 users are some of the most engaged users on most live chains.

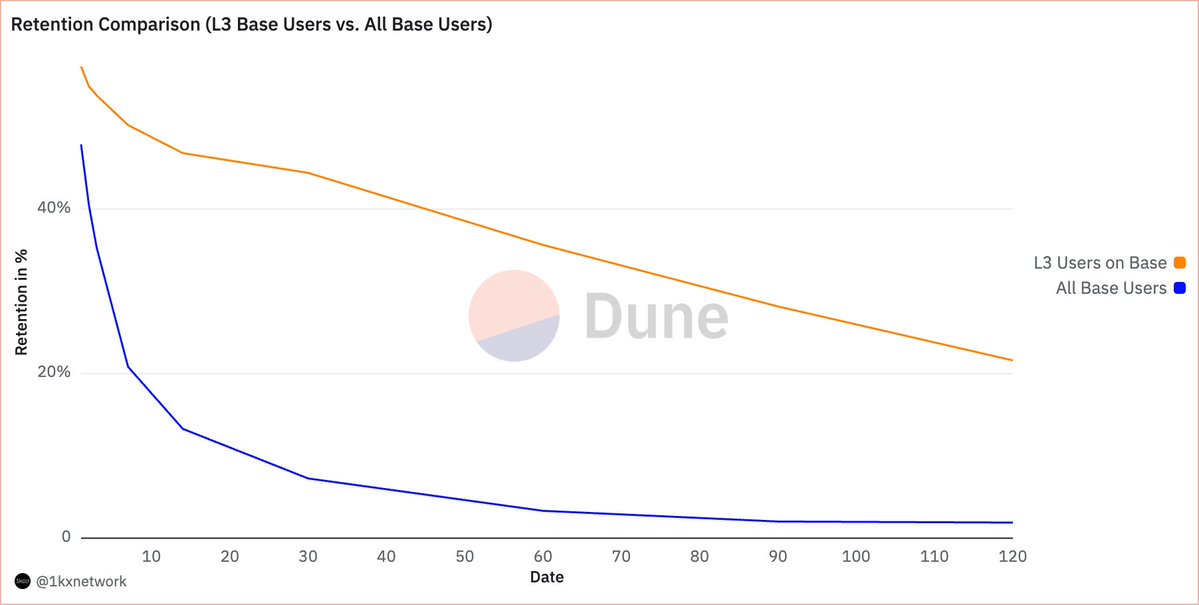

On Base, users who have used at least Layer3 once show a 6.1x higher D30 retention rate than all other onchain base addresses and a 11.3x higher rate of retention at D120. Layer3’s most active 10,000 users average 115 consecutive days of onchain use and an average of 1,525 transactions.

Layer3 has also emerged as a top 10 fee generating app on Base, and the No.1 app that isn’t a DeFi protocol in fee generation on Base (source).

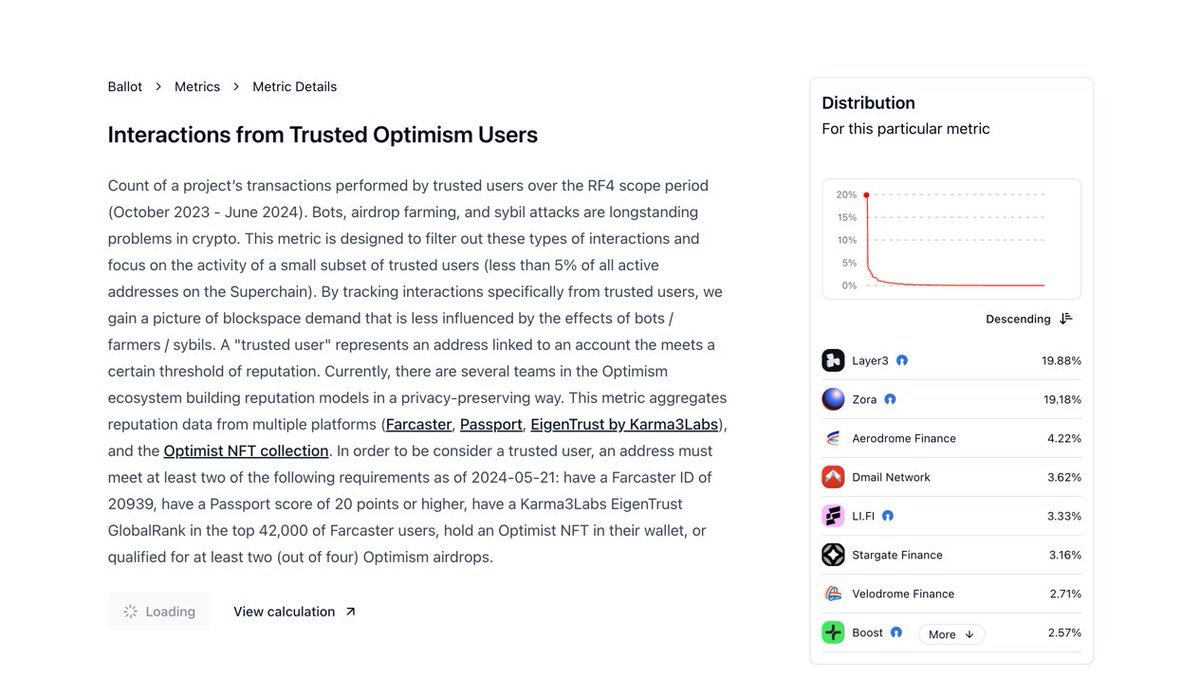

More recently, in round 4 of Optimism’s RPGF’s Layer3 was identified as the most used and trusted application by ‘high trust’ users across the Optimism superchain – a user classification which filtered heavily against bots, airdrop farming, and sybilled accounts (source).

4. Monetizing as a new attention marketplace

Layer3 is an attention marketplace and distribution network consisting of:

End users who want to participate onchain to earn

Applications and chains that need distribution

By directly addressing each party’s pain points, Layer 3 has made itself indispensable and today demonstrates clear signs of PMF.

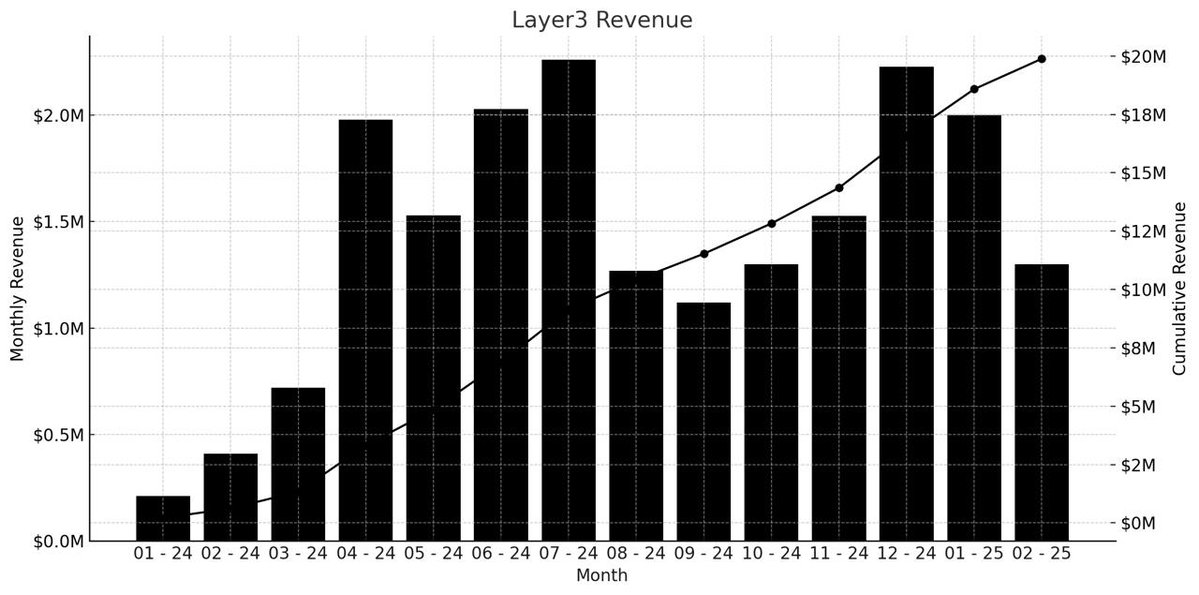

Today, it generates $15m+ of annualized revenue.

40% of this revenue is driven by applications and chains that pay to integrate to gain access to, reach, and engage the current user base.

60% is driven directly by end users that pay for the generation of ‘CUBEs’, which are onchain reputation credentials that progress their Layer3 reputation scores, allowing end users to access exclusive quests and opportunities to earn and earn $L3. The end user's consistent willingness to pay to invest in one’s future ability, even during market downturns, indicates how Layer3’s users are far longer-term users than what may initially be perceived.

By becoming the leading aggregator of onchain earning opportunities, Layer3 has accrued a significant data advantage that allows for further targeting and optimization of incentive programs.

A key example of this is how Layer3 worked with Arbitrum to enhance user acquisition and engagement. Through its CUBEs credentialing system, Arbitrum leveraged Layer3’s credentialing system to optimize its incentive program, allocating rewards only to high-value users with demonstrated onchain activity, leading to over 61,000 high-quality users completing over 1.9 million transactions (source). Onchain addresses that have used Layer3 at least 2 or more times on Arbitrum over the last 12 months have generated 3.82x more fees than all users (source)

Layer3 enabled Arbitrum to target high-quality, high-intent users who had demonstrated engagement across multiple applications and ecosystems. This granular targeting led to higher conversion rates, better retention, and a stronger network effect—as more engaged users meant more applications sought to distribute tokens through Layer3. This type of performance-driven targeting is unique to Layer3’s aggregator model, setting it apart from other distribution networks.

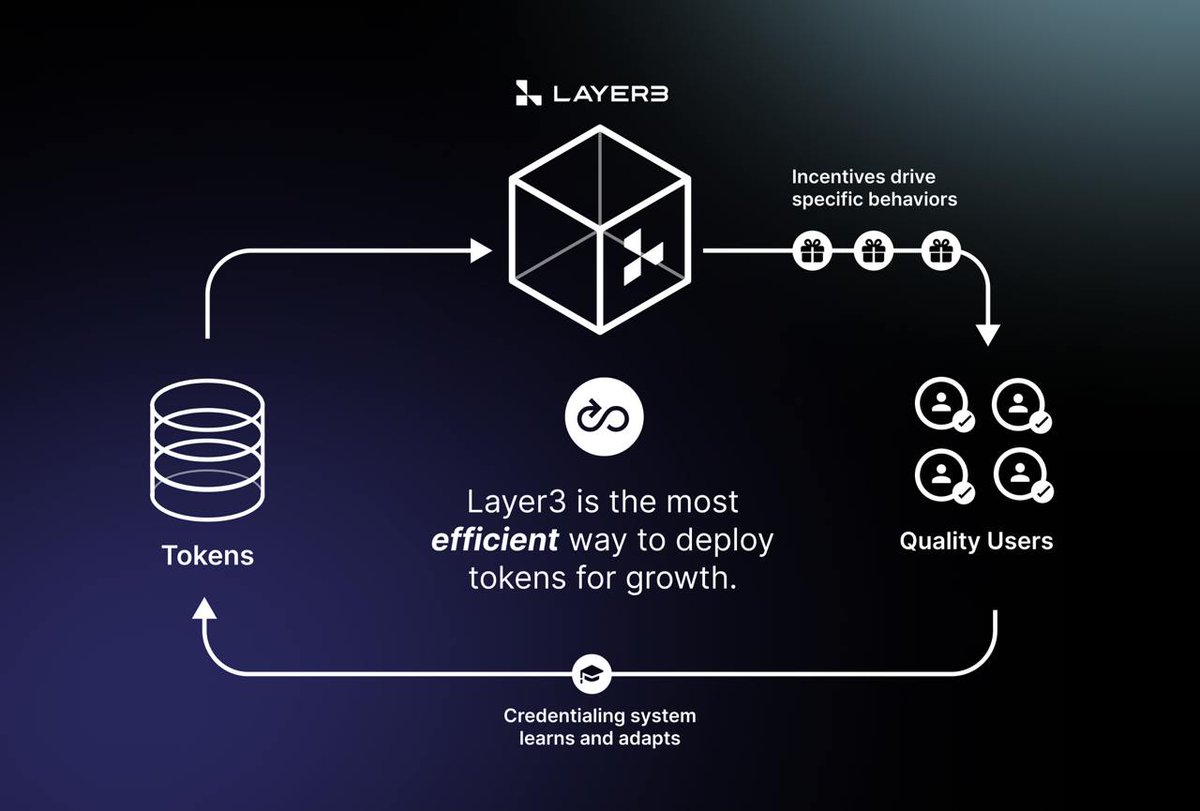

Unlike one-time airdrops or static token incentive programs, Layer3’s targeting refines itself with better data over time, similar to how Google optimizes search monetization over time, refining its ad placement and intent-matching system to create a dominant revenue engine. Similarly, Layer3’s data-driven credentialing system (CUBEs) ensures that protocols are not just distributing tokens but acquiring valuable, engaged users, making Layer3 the most efficient and defensible distribution platform in crypto.

To date, only $4m USD worth of $L3 tokens have been distributed to users, while 7.2m+ of Layer3’s users to date have earned over $285m USD worth of airdrops earned through participation with Layer3, which notably includes 20% of Arbitrum’s initial airdrop, 30% of zkSync’s initial airdrop and 83% of OP’s initial wave 1 distribution. This dynamic reinforces Layer3’s primary flywheel: as more protocols use Layer3 for user acquisition, more tokens are distributed, attracting more users, which in turn drives more protocols to the platform. Simultaneously, the sub-flywheel of CUBEs strengthens Layer3’s ability to target users, increasing protocol performance and reinforcing the value of Layer3’s data layer.

5. Verticalization as an aggregator

By owning the end-user relationship, Layer3 is incredibly well positioned to verticalize to become a fully vertically integrated consumer platform through two directional opportunities:

Horizontal expansion into adjacent product opportunities that allows Layer3 to further serve and monetize its current users while increasing their stickiness and reliance on Layer3 as it further owns the entire end user crypto journey and lifecycle.

To date, Layer3 has expanded into interfaces for trading (0.7% fee) and bridging (0.7% fee) that contribute to platform monetization. Layer3’s next major product launch is with Intel, which is tooling that enables AI agents to participate onchain to earn through missions autonomously.

Vertical expansion into infrastructure that allows Layer3 to retain value generated at the application layer while decreasing margins for end users and go to market with native solutions with their existing ecosystems partners. This gives Layer3 greater control over where it decides to make its margin in monetizing, opening optionality for Layer3 to push monetization further down the stack as a means to remain competitive during periods when there is significant market competition at the end-user level.

Layer3’s most recent demonstration of this has been in launching its own embedded wallet experience to users (Layer3 Wallet), which further removes reliance on third-party wallets but also begins to directly own the asset management layer with end users. We can expect further execution down the stack with Layer3’s chain, allowing for Layer3 to issue credentials far cheaper at scale while potentially bootstrapping its native onchain economy that would cater to first-time crypto users.

Once you own the relationship with the end user, you can go to market and monetize any newly emerging market opportunity at zero marginal distribution cost. With distribution being the key bottleneck for crypto’s most lucrative yet competitive markets, such as blockspace and trading, we believe the aggregation of opportunities to earn via quests is a trojan horse for becoming the next biggest fully vertically integrated platform that monetizes and captures value across every layer of the stack.

6. Conclusion

Layer3 is also one of the most capital-efficient businesses in the space. With a team of only 16, it maintains one of the highest revenue-per-employee ratios in the industry.

Layer3's execution pace and team quality have stood out.

While we initially talked to Layer3 during their seed round in 2022, we passed on the opportunity to invest because we wanted further validation of the market opportunity. However, as we’ve watched the opportunity grow and develop, we have not built deep conviction around the aggregation opportunity. However, we believe the Layer3 team is among the space's most effective operators. They consistently execute at a high velocity, ship new products, exhibit far greater strategic awareness, and focus on verticalization than their nearest competitors.

1kx is proud to be a supporter and backer of Layer3.

Disclaimer: This article is for general information purposes only and should not be construed as or relied upon in any manner as investment, financial, legal, regulatory, tax, accounting, or similar advice. Under no circumstances should any material at the site be used or be construed as an offer soliciting the purchase or sale of any security, future, or other financial product or instrument. Views expressed in posts are those of the individual 1kx personnel quoted therein and are not the views of 1kx and are subject to change. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell or a solicitation of an offer to buy any securities, and may not be used or relied upon in evaluating the merits of any investment. All information contained herein should be independently verified and confirmed. 1kx does not accept any liability for any loss or damage whatsoever caused in reliance upon such information. Certain information has been obtained from third-party sources. While taken from sources believed to be reliable, 1kx has not independently verified such information and makes no representations about the enduring accuracy or completeness of any information provided or its appropriateness for a given situation. 1kx may hold positions in certain projects or assets discussed in this article.