2025 ONCHAIN REVENUE REPORT:

From Mania to Maturity

by Lasse Clausen, Christopher Heymann, Robert Koschig, Clare He, Johannes SäuberlichPUBLISHED Oct 30, 2025

TABLE OF CONTENTS

- 8 KEY TAKEAWAYS

- (01)Onchain Revenue Becomes $20 Billion Economic Powerhouse

- (02)DeFi Dominates Onchain Earnings in 2025

- (03)Maturing blockchain technology has led to a reduction in transaction fees, paving the way for explosive growth in applications at 126% YoY

- (04)Asset prices are an obvious revenue driver, but more cost-efficient infrastructure is now moving the needle as well

- (05)While the top 20 protocols drive 70% of revenue, innovators can disrupt incumbents with unprecedented velocity

- (06)Though applications demonstrate greater causality between revenue and valuation than blockchains, the latter still dominates market cap

- (07)Tokenization, DePIN, Wallets and Consumer are the high-growth areas to watch

- (08)With further regulatory tailwinds, 2026 onchain fees are projected to reach 60% YoY growth at $32+ Billion, all of which is attributable to application growth

8 key takeaways

Onchain Revenue Becomes $20 Billion Economic Powerhouse

DeFi Dominates Onchain Earnings in 2025

Maturing blockchain technology has led to a reduction in transaction fees, paving the way for explosive growth in applications at 126% YoY

Asset prices are an obvious revenue driver, but more cost-efficient infrastructure is now moving the needle as well

While the top 20 protocols drive 70% of revenue, innovators can disrupt incumbents with unprecedented velocity

Though applications demonstrate greater causality between revenue and valuation than blockchains, the latter still dominates market cap

Tokenization, DePIN, Wallets and Consumer are the high-growth areas to watch

With further regulatory tailwinds, 2026 onchain fees are projected to reach 60% YoY growth at $32+ Billion, all of which is attributable to application growth

This report - the first to aggregate onchain fee data across 1,000+ protocols - analyzes sector trends, revenue drivers, fee allocations, and valuation implications. User paid fees remain the clearest signal of protocol value creation, though context is key:

At the 2021 bull-market peak, quarterly fees reached $9.2B, dominated by a few proof-of-work blockchains; Ethereum alone generated ~40% of those, as speculation made users insensitive to high transaction costs.

By 2025, transaction costs have fallen about 90% as networks optimized for efficiency, broadening adoption and allowing applications to monetize sustainably on blockchain rails. Regulatory barriers to investor participation are also easing.

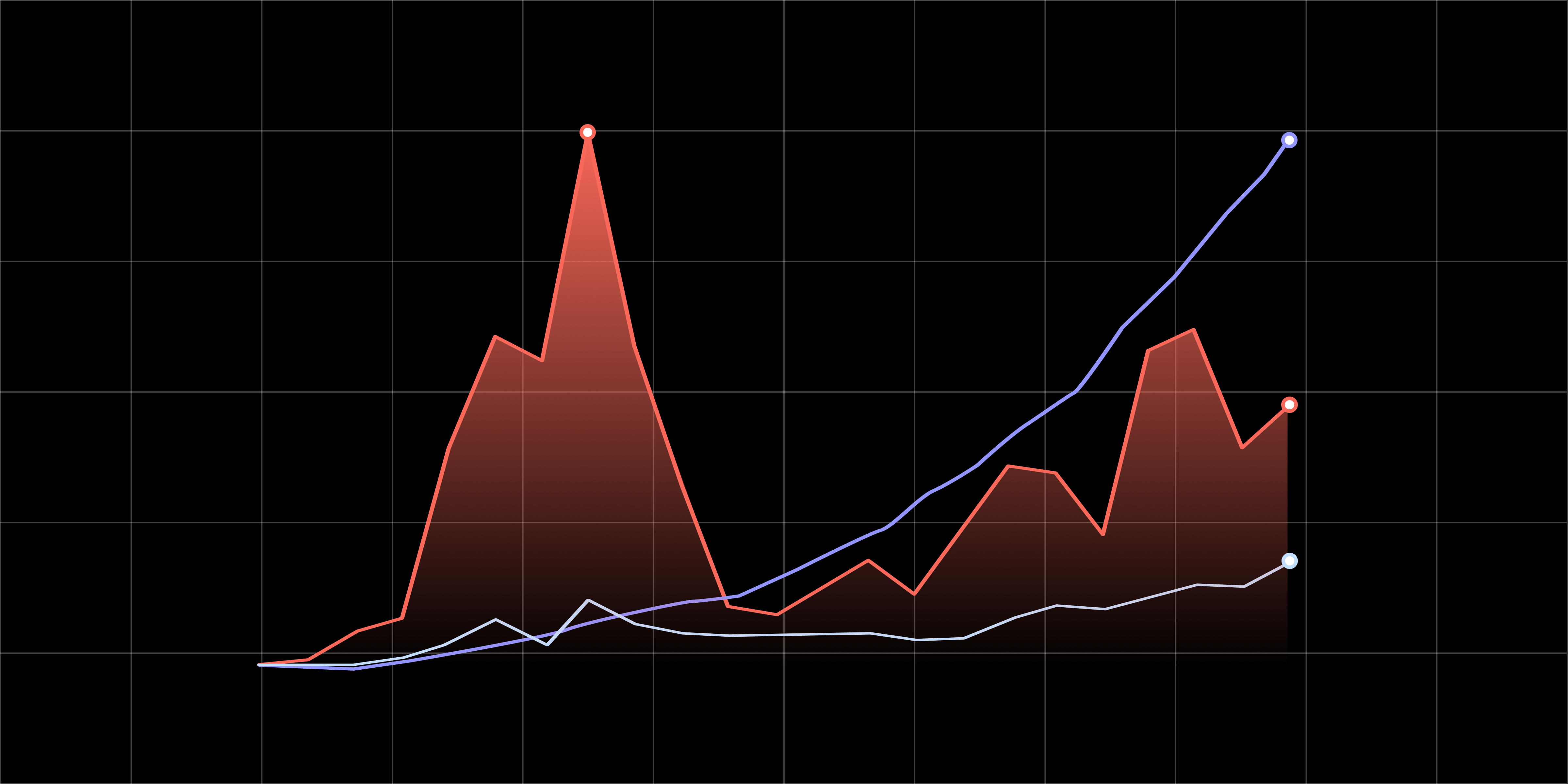

Together, these shifts mark a more mature phase of digital asset monetization - one where growth in protocol value creation and investability increasingly converge: As the light blue line indicates: allocations to token holders are at an all time high, showing that the efficiency gains allow for distribution of income. Hence, this is the time for investors to pay attention to the maturing monetization of protocols.

Onchain Revenue Becomes $20 Billion Economic Powerhouse

How Big are Onchain Fees?

Based on end of Q3 data, 2025 fees are projected at $19.8B - up 35% YoY, but still 18% below 2021 levels

Onchain fees are up over 10 times in 2025 vs. 2020, a CAGR of about 60%

Users paid $9.7 B in onchain fees in H1 2025, up 41% YoY and the highest first-half on record.

2021 remains the overall peak, driven by its second half - industry dynamics have since shifted materially, hence we are going to revisit H2 2021 throughout this report

Why do onchain user-paid fees matter?

Establishing Protocol Tokens as an investable asset class

Currently, digital tokens are primarily misunderstood as speculative assets for retail investors. This report argues they can evolve into an investable asset class for a broader, more sophisticated set of market participants, provided networks achieve product–market fit and sustainable business models.

We view fees paid as the best indicator, reflecting repeatable utility that users and firms are willing to pay for. As protocols mature and regulation improves, the ability to generate and distribute consistent fee revenue will separate durable networks from early-stage experiments.

Today, over 80% of onchain fees are generated from tokenized protocols, offering global, permissionless investment access. Exposure to offchain income is largely limited to mature listed firms or private vehicles.

Growing relevance of Onchain Activity and Efficiency

Onchain fees, though still a minority of industry income, offer clear signals of adoption and long-term value creation: 2025 YtD has close to 400 protocols with $1M+ ARR, and 20 passing over $ 10M in value to their token holders.

This is enabled by blockchain’s global reach and rising efficiency, which allow applications to scale rapidly and profitably (all shown in later sections of this report).

This has driven market share gains from off-chain competitors, e.g. DEXs now facilitate 25% of total crypto trading volume, while many high-growth business models, such as DePIN, require onchain infrastructure.

Advantage of Onchain Fee Transparency

Transparency is a core principle of blockchains - “don’t trust, verify”. Unlike traditional finance with delayed disclosures, onchain financials provide real-time, verifiable data.

For protocols issuing tokens to attract global investors, this visibility is critical: investors expect verifiable business metrics. An increasing number of protocols now disclose income or use onchain mechanisms to reflect performance, even where part of revenues remain off-chain.

Digital asset revenues extend beyond onchain fees¹⁾, though these grow the fastest enabled by maturing Blockchain technology:

Onchain fees $ 9.7B: 41% YoY growth has two diverging parts:

Blockchains moved past their high-cost, low-volume phase and are becoming commoditized infrastructure, with fees steadily declining through efficiency gains²⁾

Applications benefit from this shift, scaling rapidly on cheaper, more efficient rails, growing 126% YoY

Offchain fees $ 23.5B:

CEX revenues with the largest share, estimated $ 19B

The remainder is largely other finance infrastructure (market makers, funds AUM fees) and crypto casinos³⁾

Other income $ 23.1B splits mainly in two parts:

Block rewards for miners and stakers operating the Blockchains. They earn the most with Bitcoin ($ 8B), Solana ($ 2B) and Ethereum ($ 1B)

Stablecoin issuance: Circle and Tether generated $ 4.5B in yield on assets backing their emitted stablecoins (e.g. T-Bills)

1) See the downloadable report for a detailed breakdown;

2) See sections (02) and (04) for details

3) Stake alone reported 4.7B in gross gaming revenues for 2024

DeFi Dominates Onchain Earnings in 2025

Where are Onchain Fees Generated?

$ 9.7B was paid to protocols in H1 2025, dominated by DeFi:

63% DeFi/Finance: led by trading fees from DEXs and Perps and derivatives platforms

22% Blockchains: mainly L1 transaction fees and MEV capture; L2/L3 fees remain marginal.

8% Wallets: meaningful fees since Q4 ’24 from swap activity, driven by Phantom (30% of all Wallet fees).

6% Consumer: >80% launchpads (Pump.fun ~60% of sector), 8% casinos, 4% Creator economy and social.

1% DePINs: small, but fastest growing sector (>400% YoY)

1% Middleware: 55% Bridges (lead by Li.fi), 15% identity and reputation, 15% Developer tooling

Blockchains projected to have <20% share in fees 2025:

2021 users paid $ 13.4B for Blockchain transactions, 56% of total

When overall onchain fees resurged in 2024, Blockchains lost that lead position to DeFi/Finance Applications, which is on track for $ 13.1B / 66% of total in 2025

DeFi/Finance continuing strong growth, 113% YoY in H1 ‘25, setting an all-time high in onchain fees - see drivers next

New all-time high: H1 2025 fees surpassed the H2 2021 peak, driven by new use cases and stablecoin growth.

Established categories grew fees ~4%

DeFi DEX, perps, and derivatives gained share from CEXs¹⁾

Perps 3x’d fees as volumes grew 6x YoY, led by Hyperliquid

Lending held steady at ~$ 700M, with new entrants like Morpho improving efficiency

Stablecoins: Not a new category, but onchain fees hit records as market cap²⁾ reached new highs and monetization on off-chain collateral yields improved

Other Emerging use cases added $1.1B in fees:

Automation/DeFAI (bots and AI agents), Risk Curation and Vaults, RWAs, and Liquid (Re-)Staking - each generating fees as a share on yields leveraging user deposits

1) CEX revenues via token buybacks are opaque: buybacks are pledged to reflect revenue/profits, but verification is limited. Binance and Bitget no longer link buybacks to income, and OKX likely has not executed stated amounts in the market; hence they are excluded here

2) Stablecoin market cap close to $ 300B per end of Q3 2025

DeFi/Finance fees rose to $ 6.1B (+113% YoY) in H1 2025, reaching $ 4.4B across its core categories: DEXs, Perps and derivatives platforms, and lending. Most gains here are driven by new entrants who previously generating little revenue.

DEXs: Growth led by Raydium and Meteora, benefiting from Solana’s surge; Uniswap (#3) lagged, and consequently lost share from 44% to 16%.

Perps/Derivatives: Jupiter grew its fee share from 5% to 45%; Hyperliquid, launched less than a year ago, now contributes 35% of sub-sector fees

Lending: Aave remains dominant, though Morpho, a lending aggregator built on top of Aave, increased its fee share to 10% coming from basically 0% in H1 2024

Four significant trends for Blockchain fees:

Efficiency gains: Especially Ethereum reduced transaction costs and hence lowered overall fee income (see section (04) for the breakdown)

MEV: Flashbots protocol started facilitating the coordination for so-called MEV-transactions on Ethereum. Jito does the same on Solana. The fees paid here relate to Arbitrage opportunities, hence revenues spike during speculative periods, e.g. on Memecoins in H2 ’24/Q1 ’25.

Concentration: The top 5 protocols (Tron, Ethereum, Solana, Jito, Flashbots) captured ~80% of blockchain fees in H1 ’25. While still high, this marks an improvement from 2021, when Ethereum alone made up 86% of Blockchain fees.

Rollups (L2/L3): Emerged in 2022 as well.They charge far lower fees than L1s. Volumes remain insufficient for meaningful fee share¹⁾

1) Leading L2 is Base: ~39M in onchain fees H1 2025

Maturing blockchain technology has led to a reduction in transaction fees, paving the way for explosive growth in applications at 126% YoY

Fees vs. Value - Are we creating real economic value?

H1 2025 user paid fees are -34% vs all time high of H2 2021, but

Blockchains became efficient, sparking activity:

Ethereum alone did >40% of all onchain fees in 2021, YTD ‘25 <3% - their scaling efforts are a major driver of the 86% decrease of average blockchain transaction fees

Daily transactions on Blockchain L1s and L2s increased about 2.7 times to 169M

More protocols monetize than ever: In 2021, 125 protocols generated fees, almost all by 20 protocols¹⁾. In contrast, in H1 ‘25, 969 protocols generated fees: 8x growth in 4 years

Value distributed to token holders increased:

Despite lower fees vs. ‘21, protocols distribute 50% more value back to token holders now - an all time high

This development is accompanied by a friendlier regulatory environment for digital assets and value distribution, setting in end of 2024

1) Share of Top 20 Protocols in fees 94% in H2 2021 vs. 69% in H1 2025

Blockchain efficiency has surged, enabling higher throughput at lower cost:

Average transaction fees fell 86%, driven largely by Ethereum (accounting for over 90% of the decline), due to Ethereum's new fee mechanism (EIP-1550) and increasing L2 adoption

Lower costs broadened participation:

Average daily transactions grew 2.7x vs. H2 2021, with L2s gaining share

Similarly, the number of wallets transacting monthly rose 5.3 times to 273M in H1 2025

1,124 protocols of our dataset generated fees onchain in 2025¹⁾

389 of those started generating fees in 2025²⁾, and already account for 13% of all fees 2025 YtD, and 17% of Q3 fees

Prominent examples of this cohort are

Meteora (#1 by overall fees H1 25)

Axiom

Bullx

Trojan

2025 is the first year with a significant share of new protocols monetizing outside DeFi/Finance: Of those 150 “Others” in ‘25, DePIN and Consumer protocols are the majority

1,205 protocols generated fee income over the full timeline since 2020

1) Per Q3 2025, in Q3 ‘25 alone it was 1053

2) Specifically, fee data was available for the first time

Value distributed to token holders - the net of buybacks, burns, and other accruals minus emissions - reached record levels for the past three quarters:

$1.9B was distributed in Q3 2025, basically matching the total from H2 2021, when fees peaked

For many protocols, however, distributions remain zero, as newer networks still emit more incentives than they return to holders - a common pattern e.g. amongst Blockchain L1s

Applications drive most of the distributed value, driven by incentive reductions: top apps¹⁾ cut token incentives from $2.8B (90% of their fees) in H2 2021 to < $0.1B in H1 2025, boosting net returns to holders

Profit-based metrics such as value distribution carry caveats, especially regarding which holders benefit (active vs. passive). See slides 51 and following in the downloadable report for details on methodology and metrics used in the industry.

1) Specifically, the applications amongst the top 20 fee generating protocols

Asset prices are an obvious revenue driver, but more cost-efficient infrastructure is now moving the needle as well

What drives fees?

Asset prices are an input to dollar-denominated fees for most sectors, creating an expected correlation, but there is more:

Seasonality: Shifts in market risk appetite drive periodic swings in token prices and, in turn, fee levels

Causation¹⁾: The relationship varies by time and sector. Fee changes lead valuations in DeFi/Finance (stronger since 2022) and in Blockchains (post-2021, only for 1-month lag though)

Sector dynamics:

Blockchain L1s: Once price-driven (2021), now more impacted by transaction costs given increased efficiency

Trading platforms (DEX, Perps, etc): Remain driven by asset prices, yet take rates decreased as competition intensifies on both supply and demand sides.

Lending: Fees driven by utilization, positively correlated with prices but governed by rate mechanics.

DePIN: Fees track the dollar value of delivered services, with limited sensitivity to asset price fluctuations.

1) Granger causality of fee- and market cap changes for at least 2 major test statistics with p<0.05

Ethereum’s fee dynamics have changed sharply since 2021:

The $6.3B record in H2 2021 was driven by high ETH prices and speculative demand, with users absorbing extreme fees

By H1 2025, ETH prices and volumes were similar, but scaling efforts¹⁾ cut average fees ~95%, leading to a large drop in dollar-based fee revenue.

With positive effects for activity and inflation:

This allowed to reduce validator incentives in tandem - from $9.4B in H2 2021 to $1.2B in H1 2025 (–90%), hence ETH token supply flat since end of 2022

While Ethereum's own transaction count rose only modestly, Layer 2s now process 18x its volume, totaling ~22.9M daily transactions in H1 2025.

1) E.g. move to proof-of-stake, rollups, dynamic fees, capacity improvements, transaction-bundling

Source: https://dune.com/queries/6079590 and TokenTerminal

Uniswap, the first major DEX and long-term leader in volume and fee capture, saw fees decline 18% YoY H1 ‘25 in dollar terms, driven by a lower average fee rate:

Prices of traded assets in average increased¹⁾, driving a positive impact to fees

Swap fees range from 5–100 bps, but volumes have shifted to lower-fee pools, reducing the average take rate by >30%.

Trading volume rose 20% YoY to ~$230B in Q2 2025, but this was largely price-driven as crypto asset prices climbed even more , hence the Asset Trading Volume normalized for prices actually slightly declined

The same compression in fee rates affects other DEXs. PancakeSwap, however, offset it with higher volumes, achieving ~150% YoY fee growth

1) Whilst ETH decreased 22%, BTC increased 60% in the period

Source: DeFiLlama (transaction volume), https://dune.com/skye_cai/uniswap-v3-pool-tutorial (shares of assets in Volume)

Tokenterminal (fees)

While the top 20 protocols drive 70% of revenue, innovators can disrupt incumbents with unprecedented velocity

Who is winning? The top fee generating protocols

In line with sector shares, the top protocols are mainly DeFi/Finance, and Blockchains

Exceptions are Pump (Consumer) and Phantom (Wallets), though some protocols accrue fees across different sectors (e.g. Meteora has also a token launchpad (Consumer))

Top 20 (2% of all) protocols account for 69%, showing concentration that is typical for metrics in digital asset markets

Whilst some protocols like Uniswap, Aave and all Blockchain protocols have been live for multiple years, some protocols like Pump, Photon, and Axiom are less than 2 years old²⁾.

Rotation is common as shown on the next slide

1) Not considering double-counting of fees between protocols here, see Appendix of downloadable report for details

2) See chart after next one how the crypto-infrastructure enables quick ramp-ups in gaining multi-million in fees

Fee generation is highly concentrated:

In most sectors, the top 5 protocols capture 80%+ of fees (even higher in DePIN and Wallets) - dark blue bars

DeFi/Finance more fragmented: top 5 at 41%

Yet leadership rotates:

Up to 25% of the top 20 by Fees change each quarter

The Top 5 of ‘25 captured a lot less a year ago (light blue bars), see DePIN example in the chart

DEX overall fees are increasing with new quarterly all time high in Q4 2024. Most of the recent gain driven by DEXs on Solana, e.g. Meteora and Raydium

These DEXs didn’t have meaningful fees a year ago - Solana DEXs are both expanding market share and enlarging the overall onchain fee pool

Other protocols like Pump.fun launch new DEXs as well and reach high fee income quickly

Uniswap as established DEX leader in the past, remains their absolute levels, but loses market share as not present on Solana

Pancakeswap on the other hand grew fews with extended activity on BNB Chain, taking the lead in Q3 2025 in terms of fees

Of 1,000+ protocols analyzed, 71 have exceeded $ 100M in onchain ARR, and 32 reached that within a year of launch, a pace comparable only to top AI breakouts like Cursor²⁾. Examples include

Blockchains: Base, Filecoin, Linea

DePIN: Aethir

DeFi/Finance: Ethena, GMX, Virtuals, Sushiswap

Wallets/Interfaces: Axiom, Moonshot, Photon

Consumer: Friend.tech, LooksRare, Pump.fun

Many early surges were incentive-driven, e.g., LooksRare generated $ 500M in fees in its first three months but emitted an equal amount in rewards³⁾.

Notably, 16 of the 71 launched their platform after June 2023, all but Base as application, underscoring both the concentration of fee generation and the accelerating pace of incumbent disruption enabled by maturing infrastructure.

1) Based on Quarterly Onchain Fees

2) Meta/Facebook as fastest Web2 business in that regard took 3-4 years to achieve $100M ARR

3) LooksRare’s volumes collapsed when those incentives declined

Ethereum is the first publicly investable asset to reach a $500B+ market cap within six years (2021 bull run):

Alongside Bitcoin, it is unique in being globally accessible from inception.

Just before that valuation, Ethereum surpassed $1B in annualized fees, having taken only 2.5 years to reach $100M ARR

Ethereum’s fee income has since declined, but at its peak in Q4 2021 annualized fees approached $15B

Only energy companies with comparable speed to 500B valuations as BTC and ETH - Meta as fastest Tech company took 13.5 years

Though applications demonstrate greater causality between revenue and valuation than blockchains, the latter still dominates market cap

Is the market missing something? Onchain Fees vs Valuations

Blockchains dominate the valuations of fee generating protocols as they make 91% of the 1.2T market capitalization under consideration (which excludes Bitcoin)

Ethereum, XRP, Solana and BSC alone take ~80% of the market cap of Blockchains

DeFi/Finance 6%: Hyperliquid’s Perp DEX launched less than a year ago, yet quickly took the lead in valuation and fees

All other sectors combined have <2% of market cap

Consequently of these stark contrasts of fee- and market-cap shares, the Price to Fee ratios (Market cap over annualized fees) are above the 1000s for L1s vs. 10-100s for the other sectors (see chart after next one).

This reflects the valuation premium that market participants put on to L1s (e.g. similar to Bitcoin there is value beyond fee generation)

Divergence of shares of valuations and fees:

Blockchain valuations continue to aggregate north of 90% of the total market cap of fee generating protocols, despite their share in fees declined from over 60% in 2023 to 12% in Q3 ‘25.

Conversely, DeFi/Finance protocols accounting for 73% of all fees, though in aggregate their market cap share remains well below 10%

Price-to-fee (P/F) ratios, defined as fully diluted market cap over annualized fees, remain far higher for blockchains than for applications, reflecting the earlier divergence between valuations and fee generation:

Blockchains: The median P/F ratio in Q3 2025 is 3,902x (L1s at ~7,300x)

DeFi/Finance: The median P/F ratio is 17x (DEX at 14x, lending at 8x)

Sector ranges are broad, e.g., Blockchains span 1k–12k (Interquartile-range Q3 ‘25), but stable within those broad bands over the past three years

DePINs as one exception: Median came down to 211x from levels around 1,000x one year ago

Not all tokens represent fee-generating protocols and are excluded from fee-to-valuation comparisons. These exclusions account for 66% of the Q3 2025 average market cap:

58% Bitcoin: valued as “digital gold.” While the Bitcoin blockchain generates fees, they are immaterial to its value¹⁾

7% Stablecoins/tokenized assets: primarily stablecoins; yield on reserves is not user-paid and does not accrue to holders of these tokens

1% Memecoins²⁾: driven by speculative trading, with no cash-flow.

An additional 4% of market cap is excluded due to lack of fees or data

The resulting $1.2T / 30% of total market cap is the foundation of our analysis contrasting fees and valuations

Note: some fee-generating protocols lack tokens, hence don’t have a valuation. These represented 24% of total H1 ’25 fees, ~60% of that by Meteora, Phantom, Axiom, Photon, and Flashbots.

1) Fees as income source for miners guaranteeing Bitcoin’s security might become relevant for Bitcoin given the main source of income, the mining rewards, decrease exponentially over time

2) Memecoins that are the native token of Blockchains like Dogecoin are included in the analysis as their protocols generate transaction fees

Tokenization, DePIN, Wallets and Consumer are the high-growth areas to watch

Where is the next wave of growth emerging?

Tokenized Real World Assets (RWAs) are the smallest fee sub-sector in DeFi yet, but

RWA asset value onchain more than doubled YoY in line with a CAGR of 235% over the past four years

Onchain fees even outpaced this growth: Q3 saw 50x YoY, though on small scale ($ 15M).

These fees are earned as cut on AUM, transaction- or management fees

This growth in fees is expected to continue given regulatory tailwinds (more asset classes), increasing RWA AUM²⁾, and more offchain value flows “coming onchain”

Note that some of the largest RWA-protocols like Blackrocks BUIDL are not included in the onchain fee figure³⁾

DePIN is a relative young sector besides some of the first-movers like Helium, Akash and Arweave. More significant monetization started in the last year:

YoY fees did ~5x, with continued growth driven by Aethier and IO.Net

Aethir offering GPU-compute has a large share here, though these fees are based on buy-backs

Whilst the growth of Aethir and IO.net slowed in Q3, further sector growth is visible¹⁾ and more revenue expected to come onchain in the coming quarters²⁾

The World Economic Forum projects the valuation of the DePIN sector to $3.5 T by 2028 (~90x vs. 2025), indicating that the recent fast growth is going to continue

1) E.g. Bittensor started to report income for their increasing number of subnets

2) E.g. Helium announced to use the monthly mobile subscriptions of $ 2-3M (currently off chain) to burn HNT

Wallets and trading interfaces/apps own the direct user interaction and monetize onchain mainly via additional fees on swaps

Phantom added significant amounts here since Q4 24 in line with the activity surge on Solana

Coinbase wallet gaining fee share with monthly fee income of $ 5-15M since 12/24

Metamask lost share since Phantom and Coinbase entered fee generation

Interfaces like Photon emerged in 2024 providing trader friendly UX

As markets declined in Q2, so did fee income for wallets falling ~60% QoQ

Launchpads surged in H2 ’24, with Pump.fun leading at about $250M onchain fees in Q1 ’25

Other platforms (e.g., Launchcoin on Believe, Meteora) began monetizing in Q2 ’25 capturing marketshare

Launchpads illustrate how quickly fees can scale - though history cautions: the even sharper rise in gaming (Axie, Sandbox), and creator economy (Opensea, LooksRare) fees in 2021/early 2022 was followed by an equally steep decline

With further regulatory tailwinds, 2026 onchain fees are projected to reach 60% YoY growth at $32+ Billion, all of which is attributable to application growth

Where are Onchain Fees headed?

The base-case forecast projects $32+B in onchain fees for 2026, 63% YoY, continuing the Application driven growth trajectory:

Blockchains: Little growth; continuation of efficiency gains largely offsetting higher activity; deviations remain market-driven (e.g., ‘24/25 “Memecoin Mania”)

DeFi/Finance: Continued expansion (>50% YoY), though sensitive to asset price movements, yet supported by new sub-sectors.

Emerging sectors:

RWAs: $500M onchain fees (est. 10x YoY) in ‘26 on rising AUM projections

DePIN: >$450M, sustaining triple-digit growth

Wallets: Growth slightly higher than DeFi (50%)

Consumer: ~70% YoY increase, though with error margins on both directions

Middleware growing 50% as many protocols on the cusp to start or increase monetization (e.g. Wallet Connect)

Application fees mirrored the 2021 spike of Blockchain fees, but the recent growth in onchain fees is entirely application-driven, a trend expected to continue:

Emerging sectors like RWAs, DePIN, Wallets, and Consumer grew at triple digits in H1 2025 fees (red line) and are projected to expand another ~70% YoY in 2026.

Consumer and DePIN protocols already saw an uptick in the number of protocols monetizing in 2025 (dark line in the chart). This trend will continue across all Application sectors

Nearly all value distributed to token holders by protocols originates from applications (light blue line). Regulatory tailwinds are poised to reinforce this trend

Regulatory environment turned 180

Regulators changed approach and signal permissive environment for digital assets

More clarity for DeFi applications: MiCA, Genius Act

Evolving frameworks (Clarity Act, SEC moving to rulemaking-first vs. enforcement-first)

As regulators and elected officials become more familiar with blockchain technology, laws and regulations should become more fit-for-purpose. The new SEC Chair has called crypto and tokenization a top priority.

This environment in the US already shows that mainstream adoption is ready

Tokenized funds (BlackRock’s BUIDL fund, tokenized via Securitize)

Tokenized stocks (e.g. Galaxy’s stock $GLXY, tokenized via Superstate)

Robinhood announced its own L2 for RWAs

Depository Trust & Clearing Corporation (DTCC) announced it wants to tokenize its clearing activities

Digital Asset Treasury companies (DATs) have surged in popularity

Though, tax laws remain a blocker for more onchain flows

Onchain value flows and fee-generation still impacted by missing clarity of US tax treatment. Examples of open questions:

Is (un)wrapping a token taxable?

Are there differences in tax treatment between rebasing LSTs (stETH) and accruing LSTs (wstETH)?

When is revenue recognized on staking rewards, at accrual or claim?

Conclusion and outlook

Users paid $9.7B in onchain fees in H1 2025, the second-highest level on record since H2 2021. Back then fee generation was driven by billions of dollars in user-incentives, related speculation and a few costly PoW blockchains.

Today fees are generated primarily by applications, led by financial use cases but expanding rapidly into DePINs, Wallets, and consumer apps (each with >200% YoY growth).

Despite higher throughput, blockchain fees have remained flat as efficiency gains lowered unit costs - a trend extending to DEXs and other established protocols. This dynamic enables applications to scale quickly and profitably.

Consequently, we saw all-time highs in value distributed to token holders (e.g. via buybacks, token burns) for the past three quarters.

The regulatory environment has also shifted, with recent legislation (e.g., the Genius Act) enabling institutional participation in DeFi and expected to further legitimize value distribution to token holders.

Outlook: The 2025 data and the projected $ 32B+ / 63% YoY onchain fees for 2026 confirm an continuing uptrend in onchain monetization. Applications are scaling faster and larger than ever with increasing value distribution, while regulatory clarity supports broader investor participation. As the relationship of fees and valuations for applications show, onchain economics have entered a more mature phase where fundamental fee metrics warrant close attention from investors.

Methodology

Scope: Onchain vs. Offchain

This report primarily focuses on onchain fees¹⁾ directly paid by users for services such as transaction fees or trading fees. Hence, we exclude:

Offchain fees not transparently linked to onchain activity (e.g. CEX trading fees²⁾, Marketing or consultation fees), and

Other income related to Blockchain ecosystems is not directly paid by end users (e.g., protocol rewards, staking yields, or interest income from reserve assets)

Our focus is on aggregate fee figures, key trends, and underlying drivers across the ecosystem. Topics such as value accrual to token holders or protocol treasuries are only briefly discussed. Profitability and cost structures are outside the scope of this edition and may be addressed in future versions.

1) Please refer to slide 49 in the appendix for the distinction of Fees vs. Revenues used throughout this report

2) Note that some CEX revenues are visible onchain and hence counted as such via buybacks of CEX tokens pledged as share of revenue

Protocol Classification & Definition

Protocol classification draws on taxonomies from DeFiLlama, TokenTerminal, CoinGecko, and Messari, consolidated into six core sectors:

Blockchains (settlement of transactions, e.g. L1s like Bitcoin, L2s like Base)

Middleware (infrastructure layers between Blockchains and user-facing applications, e.g. Oracles like Chainlink)

DePIN (networks providing decentralized infrastructure like storage, compute or 5g coverage, e.g. Helium)

DeFi/Finance (providing financial services, e.g. DEXs like Uniswap, Lending markets like Aave)

Wallets (user interfaces to manage digital assets, e.g. Metamask)

Consumer (consumer oriented applications, e.g. games like Axie-Infinity or NFT-Marketplaces like Opensea)

For the purpose of this report, “Applications” refers to all non-Blockchain categories, inclusive of Middleware, DePIN, DeFi/ Finance, Wallets, and Consumer

Data Sources

Data was sourced from analytics platforms such as Dune, and aggregated data providers like TokenTerminal and DeFiLlama, which track protocol-level financial metrics.

Our dataset covers 1,244 protocols (see here for details) for the time between 2020 and including Q3 2025. Protocol valuations were sourced from CoinGecko. While not the primary focus, we also provide high-level estimates and directional insights into off-chain fees and other revenues, using third-party reports and available data sources where relevant.

We addressed double-counting of fees, e.g. L2 with L1 Blockchains, or Wallets with DEXs, see the appendix of the downloadable report for more details on methodology.

Glossary

Burn-Mint-Equilibrium: The Burn-Mint Equilibrium is a self-balancing token model where tokens are continually issued to reward contributors and destroyed through user payments—economically comparable to a company that funds operations through equity issuance while offsetting dilution via share buybacks.

CEX: Centralized exchange (e.g. Binance, Upbit) - Centralized businesses generating off-chain revenue, often with balance sheets, management, and regulatory obligations - more akin to listed financial institutions and traditional brokerage or exchange

DePIN (Decentralized Physical Infrastructure Network): These are real-economy networks that use blockchain coordination to deploy and manage physical or digital infrastructure provided by individuals or businesses rather than a single corporate operator.Examples include: Helium (decentralized wireless and IoT networks), Render (distributed GPU compute), Filecoin (decentralized data storage), Aethir (cloud and edge compute infrastructure)

DEX: Decentralized exchange (e.g. Uniswap) - Software-based marketplaces that monetize through onchain transaction fees. Whilst a CEX is like a traditional stock exchange that holds client assets and runs a business; a DEX is the open-source code version - no company, no custody, just software that earns fees every time traders use it

Governance: is how decentralized networks make and enforce decisions: A shareholder-style system where token holders, not executives, vote on the rules, fees, and resource allocation of the protocol.

Memecoin Launchpads: such as Pump.fun automate the creation, listing, and initial liquidity of new, highly speculative community tokens. Functioning as fully onchain, turnkey issuance platforms - akin to retail IPO or crowdfunding engines - they earn fees per launch and trade rather than holding inventory or underwriting risk.

By monetizing retail speculation, similar to brokerages capturing order-flow revenue, launchpads have made token creation a high-volume, low-margin business, processing thousands of launches daily. Despite the fleeting nature of the tokens, platforms like Pump.fun are highly cash-generative, with annualized onchain fees in the hundreds of millions, supported by strong volume and network effects.

Memecoin Mania: Starting in mid-2024 and extending into early 2025, the crypto market experienced a dramatic surge in Meme-based tokens launched as jokes or cultural memes without fundamental utility. Platforms like pump.fun enabled anyone to create and list a Memecoin within minutes, leading to an explosion of new issuances, particularly on Solana.

MEV (Maximum Extractable Value): In blockchain networks, MEV refers to the additional profit a validator (or block producer) can earn by reordering, inserting, or excluding transactions within a block before it is finalized. It’s essentially value extracted from controlling the order of trades - not from changing the trades themselves, but from deciding when and in what sequence they happen. The closest parallels in traditional finance are:

High-Frequency Trading (HFT) latency arbitrage: traders profit from seeing orders milliseconds before the market does.

Broker-dealer internalization: a market maker executes client orders in-house, potentially reordering them for profit.

Specialist’s book control on a stock exchange: historically, specialists could match orders in ways that benefited them.

The difference: In blockchains, the validator has full discretion over transaction ordering inside their block, making these opportunities transparent (onchain) and enforceable by code.

Node sale: is how esp. DePINs finance and distribute their capacity — investors purchase and operate nodes, earning network fees or tokens much like owning productive assets in a digital utility

Onchain fees: are fully recorded on the blockchain, with both payer and recipient identifiable via wallets (e.g., user payments to validators). See under “offchain fees” how we extend this to buybacks.

Offchain fees: occur outside the blockchain—for example, credit card payments for DePIN services or in-game purchases. Some are later “brought onchain” when protocols transfer fiat proceeds or conduct token buybacks, which are typically non-verifiable since it is unclear whether tokens were repurchased on the market or sourced internally. We include such income in onchain fee figures unless clearly not market-sourced. Many businesses, esp. CEXs and market makers, retain most income offchain with limited disclosure. Even if parts are held in blockchain wallets, the lack of transparency renders them effectively offchain. Some exchanges (e.g., Binance, Gate, Bitget) link offchain profitability to onchain token economics through buyback programs, but since only token movements, not their funding sources, are visible, these mechanisms remain opaque and unverifiable

Staking: Staking is the process of committing (“locking up”) a certain amount of a cryptocurrency to support the operations of a blockchain network, often in a proof-of-stake (PoS) system. In return, one earns periodic rewards, similar to earning interest or a dividend, paid in the same cryptocurrency. One can think of staking as a hybrid between a dividend-paying stock and a performance bond:

Like owning stock and receiving dividends, you hold tokens and get paid rewards for contributing to the system.

Like posting collateral or a surety bond, your stake can be forfeited if you or your validator fail to meet obligations.

In some ways, it also resembles a term deposit in banking—your capital is locked for a certain period, and you’re compensated with yield.

Tax token: A blockchain-based token whose smart contract is programmed to automatically collect a fee (“tax”) on every transaction involving that token. This fee is deducted directly onchain at the moment of transfer and routed to a predefined wallet or set of wallets. One can think of it as a security with an embedded, automated transaction levy — except in crypto, there’s no clearinghouse or transfer agent doing the deduction; it’s built into the token’s code itself.

Token Burn: is the permanent removal of tokens from circulation, typically by sending them to an inaccessible (“burn”) address. Economically, it functions similarly to a share buy- back followed by retirement in traditional finance, reducing the total supply and potentially increasing the value of remaining tokens, assuming demand remains constant or grows.

Token rewards/Incentives: Are units of a blockchain’s native cryptocurrency (or another digital token) that are granted to participants for contributing to the network or engaging with a protocol. They are a form of incentive compensation, paid not in cash but in the protocol’s own asset. Token rewards are typically issued to: Validators / Miners, for securing the network (e.g., adding blocks, validating transactions), Liquidity Providers, for supplying assets to decentralized exchanges or lending pools, Users / Community Members – for adopting or promoting the platform (e.g., airdrops for early users). The goals are to: Bootstrap activity in a new network (similar to offering equity options in a startup), reward ongoing contributions that sustain operations, and align incentives between the protocol and its stakeholders. One can think of token rewards as a hybrid between: Stock options or equity grants (they give you a stake in the growth of the network), In-kind dividends (instead of paying in cash, the company/protocol issues more of its own shares/tokens, or Loyalty program points (earned by participating, redeemable within the ecosystem (though here, the “points” are often tradable on open markets)).

Value distributed to Token Holders: This metric reflects the net value accruing to token holders, analogous to dividends or buybacks in traditional finance. It aligns with Holder Revenue (per DeFiLlama), representing the share of protocol income distributed to holders - typically through buybacks, burns, or rewards (often limited to active holders, e.g. stakers, governance participants).

It also adjusts for dilution, as some holder revenue coincide with new token emissions, potentially resulting in negative net value. Since such dynamics are common in Blockchains, early-stage protocols or part of the design (e.g. Burn-Mint-Equilibrium) we report only positive net distributions when aggregating across protocols,, consistent with how aggregated numbers of capital returns are treated in corporate finance.

Legal Disclaimer

This report is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of 1kx LP, a Cayman Islands exempted limited partnership, and 1kx Ltd., a Cayman Islands exempted company (collectively, “1kx” or the “Fund”), managed by 1kx Management Ltd., a BVI business company (the “Investment Manager”), are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the Fund (such documents, the “Offering Documents”). Any decision to invest must be based solely upon the information set forth in the Offering documents, regardless of any information investors may have been otherwise furnished, including this report.

An investment in any strategy, including the strategy described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal. Securities of the Fund are not registered with any regulatory authority, are offered pursuant to exemptions from such registration, and are subject to significant restrictions.

The information in this report was prepared by the Investment Manager and is believed by the Investment Manager to be reliable and has been obtained from public sources believed to be reliable. The Investment Manager makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this report constitute the current judgment of Investment Manager and are subject to change without notice. Any projections, forecasts and estimates contained in this report are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This report is not intended as a recommendation to purchase or sell any digital currency, digital asset, commodity or security. The Investment Manager has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

The graphs, charts and other visual aids in this report are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

This report is strictly confidential and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person without the express consent of the Investment Manager.